The Markets in Crypto-Assets Regulation (MiCA) is here - EU framework for crypto assets with global role model potential

In September 2020, the first draft of MiCA was published - after more than two years, the uniform EU framework has now taken its final shape. What’s missing is only the final approval of the European Parliament and the publication in the official journal. MiCA creates an EU-wide legal framework for crypto assets, stablecoins, crypto markets and crypto asset service providers (CASPs), which were previously not regulated, at least not regulated uniformly throughout the EU. The regulation thus provides legal certainty and replaces individual member state regulations, thereby promoting innovation and fair competition in the EU while ensuring a high level of consumer protection and market integrity. MiCA thus has the potential to become a blueprint for a global regulatory standard.

In the course of the legislative process, MiCA has undergone numerous changes. We want to give you an overview and answer the most important questions: what kind of crypto assets are covered, when is a whitepaper to be prepared and what regulations apply to stablecoins?

Which crypto assets are covered?

The starting point for the application of MiCA regime is the notion of crypto-assets. According to the legal definition, a crypto-asset is a digital representation of a value or a right which may be transferred and stored electronically, using distributed ledger technology or similar technology. This includes, for example, cryptocurrencies such as Bitcoin (BTC) or Ether (ETH). MiCA contains a detailed set of regulations for the following categories of cryptocurrencies:

- (Significant) asset-referenced token (ART)

- (Significant) electronic money or e-money token (EMT)

- All other crypto-assets, that are not ART or EMT, including

- utility token.

EMT and ART are often referred to as stablecoins, even though MiCA does not use this terminology. An EMT is a crypto-asset that purports to maintain a stable value by referencing to the value of one official currency - in other words, a government-issued currency such as the EUR or USD. Therefore, stablecoins such as USDC and EUROC are likely to qualify as EMTs. An ART is considered to be a crypto-asset that is not an EMT and that purports to maintain a stable value by referencing to any other value or right or a combination thereof, including one or more official currencies.

In addition, utility tokens are now also subject to regulation, whereas previously they were not regarded as crypto-assets within the meaning of the German Banking Act (Kreditwesengesetz), but will qualify as crypto-assets within the meaning of MiCA. A crypto-asset is deemed to be a utility token if it is only intended to provide access to a good or a service supplied by the issuer of that token. If a token contains additional rights, functions or servers other purposes, it must be examined in each individual case whether it also qualifies as an ART or EMT or as a financial instrument within the meaning of Directive 2014/65/EU (MiFID II). In general, if a crypto-asset (also) qualifies as a financial instrument within the meaning of MiFID II or as an investment fund, deposit, structured deposit or securitisation, the relevant specific EU directives (and corresponding transposition legislation) and regulations must be applied instead of MiCA.

When is a white paper required and who needs to draft and publish a white paper?

MiCA introduces a general obligation to publish a white paper for all types of crypto-assets. For crypto-assets other than ART and EMT that will be offered to the public or for which admission to a trading platform is sought, the white paper must be notified to the national competent authority (in Germany, this would be the Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin). However, no (prior) authorisation by the respective national competent authority is required. Offerors or persons seeking admission to trading of a crypto-asset must notify their national competent authority in which other EU member states they intend to offer the crypto-asset or seek admission to trading. The national competent authority will then inform the authority/ies of the other EU member state(s) accordingly so that the white paper can be passported, i.e. also used in these EU member states.

Not only the issuer or offeror is responsible for the drafting and notification of a white paper, but also the operator of a trading platform seeking admission to trading of crypto-assets or the person applying for admission to trading. Thus, if a trading platform, on its own initiative, intends to offer a crypto-asset on its platform for which no white paper has been published in accordance with MiCA requirements, it would be obliged to draft and notify a white paper prior to listing. The respective creator of a white paper is liable for incomplete or misleading information in the white paper. This means that the operator of a trading platform may also be liable for the information in the white paper, as the case may be together with the person who sought admission to trading. White papers and marketing communications must also be kept up to date during the entire period of the public offering or the listing of the crypto-assets.

What rules apply to stablecoins and stablecoin issuers?

In order to be able to offer or seek admission to trading of ARTs in the EU, the issuer of such stablecoins must be a legal person or undertaking established in the EU and must either have been granted MiCA authorisation by its national competent authority or be a credit institution. Exemptions apply if over a period of twelve months, calculated at the end of each calendar day, the average outstanding value of all ARTs does not exceed EUR 5 million or its equivalent in another currency, or if the public offer of the ART is directed solely at qualified investors and can only be held by such qualified investors. In any case, a white paper shall be produced in accordance with the MiCA and notified to the competent authority.

The authorisation as ART issuer and the white paper are valid throughout the EU. In addition, the ART issuer must comply with certain organisational and compliance requirements. In addition to capital requirements, MiCA contains provisions on the reserve assets with which ARTs are backed, as well as provisions on the redemption of ARTs. The holder of an ART may at any time request the issuer to redeem an ART in funds or in the form of the referenced assets. Certain limits are placed on the issuance of ARTs so that they do not become a generally accepted means of payment. For example, an ART issuer must cease further issuance of ARTs if the estimated quarterly average number and value of transactions per day in connection with the use as means of exchange would exceed 1 million transactions or EUR 200 million within a single currency area.

In addition, MiCA establishes requirements for EMT issuers. Only those who are authorised as credit institutions or electronic money institutions may be EMT issuers. The specific requirements under MiCA therefore apply in addition to the general requirements for electronic money institutions or credit institutions. Holders of EMTs have a right to redeem the EMTs against the issuer at any time for money (that is not e-money). As is the case for ARTs, an EMT issuer must prepare a white paper, which must be notified to, but not approved by, the competent national authority. An EMT issuer is liable for the information in the white paper to EMT holders. In addition, MiCA contains rules on how the funds received upon issuance of EMTs may be invested (esp. only in highly liquid financial instruments).

Authorisation and organisational requirements for CASPs - what advantages do German companies have?

MiCA provides a harmonized framework for the authorisation and notification requirements for CASPs throughout the EU. Anyone who intends to offer crypto-asset services in the EU requires authorisation as a CASP, unless the company is already authorised to provide comparable services as a credit institution, central securities depository, investment firm, market operator, e-money institution or capital management company of UCITS or alternative investment funds.

The custody and administration of crypto-assets, the operation of a trading platform for crypto-assets, the exchange of crypto-assets for funds, the exchange of crypto-assets for other crypto-assets, the execution of orders for crypto-assets, the placing of crypto-assets, transfer services for crypto-assets, the reception and transmission of orders for crypto-assets, providing advice on crypto-assets and portfolio management on crypto-assets will be regulated as crypto-asset services.

Custodians of crypto assets must keep their own assets and customer assets segregated. In addition, MiCA contains rules on liability for crypto custodians and imposes comprehensive requirements for the business organisation of CASPs, which are largely comparable to the requirements for investment firms. It’s important to note that companies offering crypto-asset services in Germany already today need to obtain a license as a financial services institution or investment firm and must comply with the corresponding business organisation requirements under German national law. This means that companies licensed in Germany will therefore be able to transition to MiCA requirements without major adjustments, which might give them a head start. In addition, it is envisaged that service providers who already have a comparable authorisation under national law will be able to transition from their national license to a MiCA authorisation in a simplified procedure.

Can companies operate throughout the EU and what about companies from third countries?

MiCA allows companies to offer crypto-asset services cross-border throughout the EU. This means that, unlike today, companies do not have to get registered or licensed separately in each member state where they want to provide their crypto-asset services. While they are free to set up local subsidiaries or branch offices, companies can also opt to passport their services to other EU markets on a cross-border basis from their licensed entity.

For third country firms, MiCA provides guidelines to delineate what is considered "reverse solicitation" and at what point a targeted market approach triggers licensing requirements. To the extent customers domiciled in an EU member state are using a crypto trading platform domiciled in a third country on their own initiative, this crypto trading platform does not require a MiCA authorisation.

What regulations apply with respect to market abuse?

MiCA contains a bespoke regime on disclosure of inside information, prevention and detection of insider dealing and market manipulation. CASPs involved in the arrangement and execution of transactions must put in place arrangements, monitoring systems and procedures to monitor and detect market abuse.

Are DeFi applications, consensus mechanisms and NFTs also in scope of MiCA?

Throughout the legislative process, there was a heated debate on whether non-fungible tokens (NFTs) should be covered by MiCA, whether blockchains based on the proof-of-work consensus mechanism should be banned because of their carbon footprint, and whether DeFi applications and decentralised exchanges (DEX) should be regulated by MiCA.

MiCA does not (yet) contain a separate framework for NFTs. In principle, crypto-assets that are unique and not fungible or interchangeable with other crypto-assets, including digital art and collectibles whose value is attributable to the unique characteristics of each crypto-asset and the utility it provides to the token holder, are not subject to MiCA. This also applies to crypto-assets that represent services or physical assets that are unique and non-fungible, such as product guarantees or real estate. Even NFTs that are acquired for speculative purposes or can be traded on marketplaces are not regulated by MiCA if they fulfill those requirements. However, the assessment changes if NFTs can be fractionalised or large series and collections of an NFT are issued - in these cases they most likely can no longer be regarded as unique and non-fungible.

MiCA provides that negative climate and other environmental impacts related to the underlying consensus mechanism of a DLT must be disclosed. It is also expected that more environmentally friendly consensus mechanisms will be used more widely in the future. However, a ban on certain consensus mechanisms such as proof-of-work, as was still proposed in an earlier draft of MiCA, is now off the table.

Decentralised applications or DeFi protocols are not covered by MiCA for the time being, provided they enable crypto-asset services that are fully decentralised without an intermediary.

When does MiCA apply?

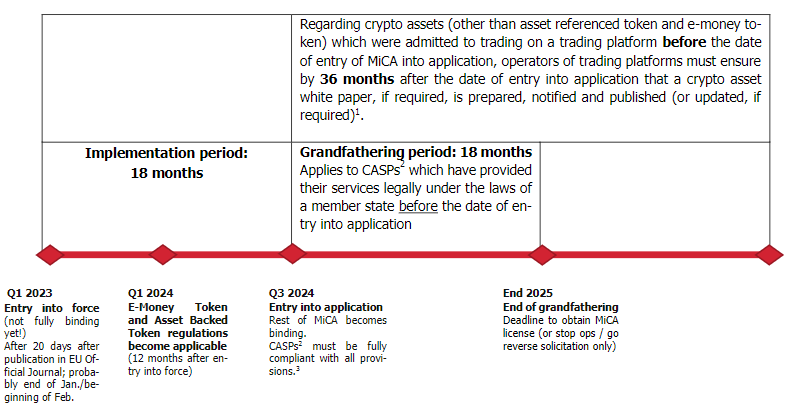

MiCA enters into force 20 days after its publication in the official journal of the EU. However, this does not mean that the individual provisions are already fully applicable. Below we outline the timline for MiCA’s entry into application:

1 General rule behind this 36-moths-regulation: Offerors of a crypto asset (other than an asset referenced token or e-money token), persons asking for admission of a crypto asset to trading on a trading platform, and operators of a trading platform admitting a crypto asset to trading on the platform on their own initiative must prepare, notify and publish a white paper | 2 Crypto Asset Service Provider(s) | 3 Except provision to hold a MiCA license

Über uns

YPOG steht für You + Partners of Gamechangers und zukunftsweisende Steuer- und Rechtsberatung. Die Kanzlei berät auf Zukunftstechnologien fokussierte Unternehmen mit dem Ziel, Wandel als Chance zu nutzen und gemeinsam optimale Lösungen zu schaffen. Das Team von YPOG bietet umfassende Expertise in den Bereichen Funds, Tax, Transactions, Corporate, Banking, Regulatory + Finance, IP/IT/Data Protection, Litigation sowie Corporate Crime + Compliance + Investigations. YPOG ist eine der führenden Adressen in Deutschland für Venture Capital, Private Equity, Fondsstrukturierung und Anwendungen von Distributed Ledger Technology (DLT) in Financial Services. Die Kanzlei und ihre Partner:innen werden regelmäßig von renommierten Publikationen wie JUVE, Best Lawyers, Chambers and Partners, Leaders League und Legal 500 ausgezeichnet. Bei YPOG sind mehr als 180 erfahrene Rechtsanwält:innen, Steuerberater:innen und Tax Specialists sowie eine Notarin in den Büros in Berlin, Hamburg, Köln, München, Cambridge und London tätig.

Weitere Informationen: www.ypog.law und www.linkedin.com/company/ypog