EBA publishes No Action letter on the interplay between PSD2 and MiCAR in relation to crypto-asset service providers that transact electronic money tokens.

On 10 June 2025, the European Banking Authority (EBA) published a No Action letter on the interplay between Payment Services Directive (PSD2/3) and Markets in Crypto-Assets Regulation (MiCAR).

E-money token (EMT) are not only MiCAR-regulated crypto-assets but are also deemed e-money within the meaning of the E-Money Directive (EMD2) and Payment Services Directive (PSD2). For crypto-asset service providers (CASPs) authorized under MiCAR, the question arises whether they require an additional authorization under PSD2 (in Germany under the Payment Services Supervision Act, Zahlungsdiensteaufsichtsgesetz - ZAG) for the provision of services relating to EMT.

The European Commission (COM) asked EBA for clarification on the interplay between MiCAR and PSD2 at the beginning of December 2024. EBA was also asked to examine the possibility of a so-called No Action letter, i.e. a (temporary) "suspension" of the PSD2 regime for CASPs.

EBA has now reacted - and clarified that (after a transition period until March 2026) CASPs providing transfer and certain custody services regarding EMT require an additional PSD2 authorization.

1. Executive Summary

EBA requests national supervisory authorities (NCAs) to refrain from enforcing PSD2 with regard to EMT-related services provided by CASPs until 1 March 2026.

However, from 2 March 2026 onwards, CASPs will need a PSD2 authorization (or must rely on a PSD2-regulated payment service provider) for the following EMT-related crypto-asset services :

- Transfer services, i.e. any transfer of EMTs between different wallets on behalf of customers, including transfers between two wallets of the same customer. This includes, for example, the “payout” of EMT by a crypto custodian to a reference wallet (so-called first-party transfers).

- Custody and administration services, i.e. the provision of a custodial wallet on behalf of a customer that allows sending and receiving EMTs to/from third parties.

EBA clarifies, that the exchange of EMTs against funds or other crypto-assets using the CASP’s proprietary capital (i.e. proprietary trading) does not qualify as a payment service.

With regard to the PSD2 authorisation procedure, the EBA recommends that NCAs make use of MiCAR documentation already submitted by CASPs, as far as possible.

From 2 March 2026, certain PSD2 requirements – such as safeguarding obligations – will only apply to CASPs to a limited extent.

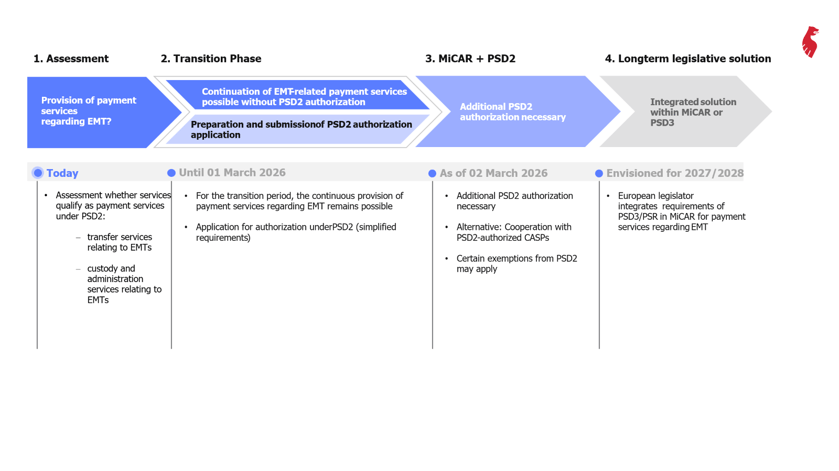

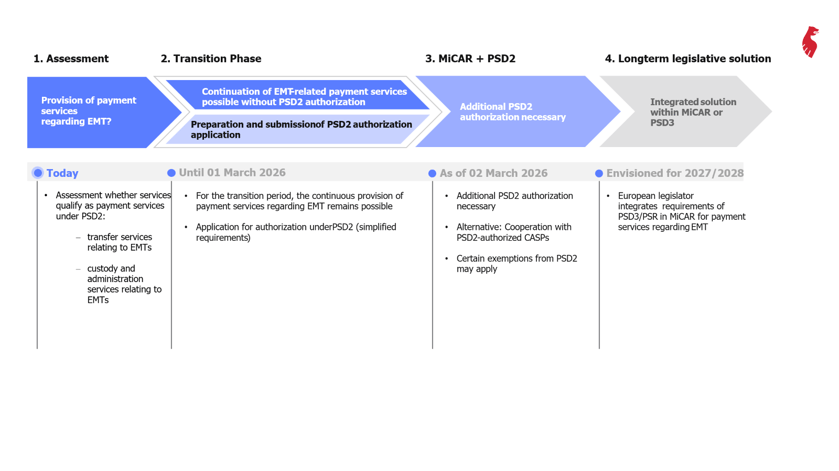

The following graphic outlines the deadlines and next steps based on the EBA’s No Action letter:

2. No Action Letter by EBA

2.1 EMT-related services as payment services within the meaning of PSD2

In its No Action letter, EBA recommends that NCAs treat the following EMT-related services as payment services within the meaning of PSD2:

- The transfer of EMTs when offered and executed by a CASP on behalf of its client.

- This applies regardless of whether it is a transfer to third parties or a so-called "first-party transfer”, i.e. transactions between two wallets held by the same customer. A transfer from a custodial wallet to the customer’s reference wallet is also covered.

- EBA rejects an additional condition proposed by market participants during previous EBA workshops, according to which a “payment” should only cover transactions aimed at the purchase of goods or services.

- Depending on the qualification of the custodial wallet as a payment account (see below), such transfer services either qualify as a payment service in the form of execution of payment transaction (Annex I, no. 3) of PSD2) or in the form of money remittance (Annex I, No. 6) of PSD2). This distinction is relevant, among other things, for the calculation of initial capital requirements and own funds.

- Custody and administration of EMTs

- EBA finds that, from a functional perspective, a custodial wallet operated on behalf of one or more customers allowing to send and receive EMT to and from third pars qualifies as a payment account within the meaning of Art. 4 No. 12 PSD2.

- The custody and administration of EMT via such a wallet then constitutes a payment service - namely the operation of a payment account within the meaning of Annex I No. 1 and 2 PSD2.

This means that CASPs providing transfer services within the meaning of Art. 3(1) No. 16 lit. j MiCAR in relation to EMTs are generally subject to the authorization requirement under PSD2. The same applies to CASPs offering custody services within the meaning of Art. 3(1) No. 16 lit. a MiCAR - irrespective of whether the custodial wallet qualifies as a payment account. This is because, the mandatory return of EMTs to a reference wallet of the customer in accordance with MiCAR (see Art. 75(6) MiCAR) qualifies as a transfer of EMTs in any case - and therefore as a payment service within the meaning of PSD2.

However, it is unclear whether the mere change of allocation of EMT held in a collective (omnibus) wallet in CASPs’ book-keeping systems falls under PSD2. One could argue that because this is merely a consequence of trading, e.g. because a trading platform operator (or a cooperation company) holds the crypto-assets for trading customers, it does not qualify as a transfer and payment service. Further clarification would be desirable, as the No Action letter still leaves some room for interpretation in this regard.

2.2 Which EMT-related services are not considered payment services?

According to EBA, the following should expressly not be considered payment services:

- The mere custody of EMTs, provided the wallet does not qualify as a payment account within the meaning of PSD2 - i.e. no transfers of EMTs to third parties or from third parties are made via this wallet.

- The mere exchange of EMTs for funds or other crypto-assets, provided the CASP acts on its own behalf (i.e., proprietary trading).

- Activities that fall under one of the exemptions of Art. 3 PSD2 (such as the group exemption or "limited network/range" exemption).

2.3 Transition phase until 1 March 2026

EBA recommends that NCAs grant a transitional period until 1 March 2026 during which affected CASPs are not required to obtain authorisation under PSD2 for providing EMT-related services that also qualify as payment services.

From 2 March 2026, CASPs must either

- hold their own authorization under PSD2, or

- provide their EMT-related payment services in cooperation with an authorised payment service provider.

2.4 Simplification of PSD2 authorization procedure

The authorization procedure under PSD2 shall be simplified for the CASPs concerned. To unnecessary duplication of requirements, EBA advises NCAs to streamline the authorization procedure and to use information already submitted in the MiCAR authorization procedure as far as possible – provided that the submitted information is still valid and up to date. Ideally, NCAs will ensure a consistent and harmonised application of this approach across Member States.

2.5 (Simplified) obligations after obtaining authorization

Even after 2 March 2026, EBA recommends that NCAs apply and enforce certain PSD2 requirements for CASPs (with an additional PSD2 authorisation) only on a risk-based basis for the time being. This applies in particular to

- Safeguarding requirements,

- Open banking provisions and

- Certain transparency and information requirements that are technically difficult to implement – for instance, the advance disclosure of exact payment fees, where this is not feasible due to unforeseeable network fees (e.g. gas fees).

However, the following requirements are to be fully applied without exception:

- Strong customer authentication (SCA),

- Fraud reporting and

- Calculation of own funds (cumulative with own funds requirements under MiCAR).

2.6 Call for a long-term legislative solution

Finally, EBA recommends EU legislators to establish a coherent and permanent regime for EMT-related payment services as part of the PSD3/PSR reform to avoid double regulation: MiCAR could either be amended to integrate established protection standards applying to payments or, alternatively PSD3/PSR could be extended and include a (simplified) notification procedure for CASPs providing such services.

Download YPOG Briefing: EBA’s No Action letter on the interplay between PSD2 and MiCAR – Two is (not always) better than one

YPOG stands for You + Partners of Gamechangers – forward-thinking legal and tax advice. Supporting companies that are focused on emerging technologies, YPOG embraces change as an opportunity to develop cutting-edge solutions. The YPOG team offers comprehensive expertise in the areas of Funds, Tax, Transactions, Corporate, Banking, Regulatory + Finance, IP/IT/Data Protection, Litigation, and Corporate Crime + Compliance + Investigations. YPOG is one of the leading law firms in Germany for venture capital, private equity, fund structuring, and the implementation of distributed ledger technology (DLT) in financial services. Both the firm and its partners are regularly recognized by renowned national and international publications such as JUVE, Best Lawyers, Chambers and Partners, Leaders League, and Legal 500. YPOG is home to more than 180 experienced attorneys, tax advisors and tax specialists as well as a notary, working across offices in Berlin, Cologne, Hamburg, Munich, Cambridge and London.

Further information: www.ypog.law/en/ and www.linkedin.com/company/ypog